How to Open a Second Cash App Account: A Comprehensive Guide

Want to manage your finances more effectively by separating personal and business transactions on Cash App? Perhaps you’re looking for a way to budget more efficiently or simply want a fresh start. The question of how to open a second Cash App account arises frequently, and while the official stance might seem limiting, there are workarounds and important considerations to be aware of. This comprehensive guide will delve into the nuances of using multiple Cash App accounts, the official policies, alternative strategies, and crucial factors to ensure you remain compliant with Cash App’s terms of service. We’ll explore the potential benefits and drawbacks, offering expert advice to help you make informed decisions. This article aims to provide a definitive resource, blending practical guidance with a thorough understanding of Cash App’s ecosystem.

Understanding Cash App’s Official Policy on Multiple Accounts

Before exploring alternative strategies, it’s crucial to understand Cash App’s official position on multiple accounts. Cash App’s terms of service generally discourage users from creating more than one account. The primary reason is to prevent fraudulent activities and maintain the security of the platform. Having multiple accounts can potentially be seen as a way to circumvent transaction limits or engage in activities that violate the terms of service. However, the need for separate accounts is a valid one for many users, so understanding the rules is the first step.

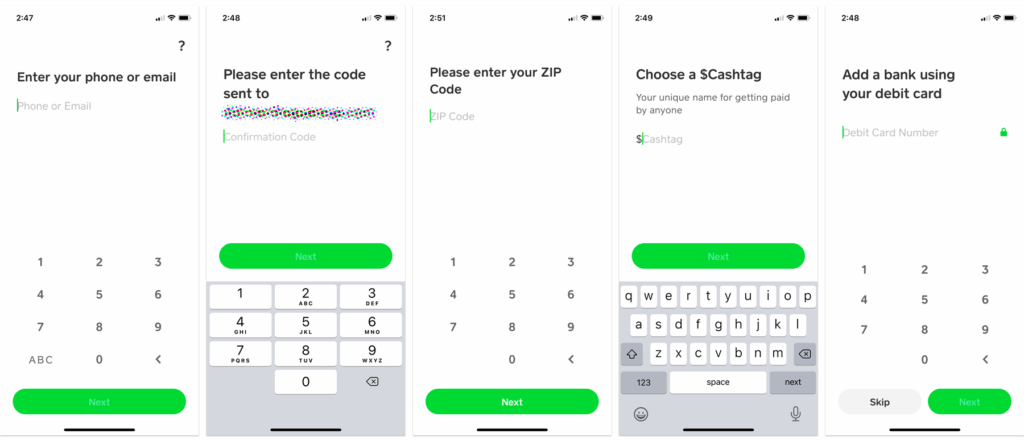

Cash App requires users to verify their accounts with a valid phone number, email address, and bank account. This verification process is designed to ensure that each user is unique and identifiable. Creating multiple accounts with the same information would be a direct violation of these terms. The risks of violating these terms can include account suspension, permanent ban, and potential legal repercussions if the accounts are used for illicit activities. Therefore, it’s essential to proceed with caution and explore legitimate alternatives rather than attempting to bypass the system.

Legitimate Reasons for Needing Multiple Cash App Accounts

Despite the restrictions, legitimate reasons exist for needing more than one Cash App account. Freelancers and small business owners often require separate accounts to manage business income and expenses. This separation simplifies bookkeeping, tax preparation, and overall financial management. Using a personal account for business transactions can lead to complications, making it difficult to track business performance and comply with tax regulations. Many users also find a second account useful for budgeting. They can allocate funds for specific purposes, such as savings, investments, or recurring bills, preventing overspending and improving financial discipline. Another common use case is managing finances for different projects or events. For example, someone organizing a group trip might create a separate account to collect funds and track expenses transparently.

Exploring Workarounds and Alternative Strategies

While directly creating multiple accounts is discouraged, users have explored various workarounds to achieve similar goals. One approach is to use different email addresses and phone numbers for each account. However, this method carries the risk of violating Cash App’s terms of service if the accounts are linked or used for suspicious activities. A safer alternative is to utilize Cash App for Business. This feature allows users to create a business profile within their existing account, enabling them to accept payments, track sales, and manage business finances separately. Cash App for Business provides tools and features specifically designed for business owners, making it a more compliant and efficient solution than creating multiple personal accounts. Another strategy is to use alternative payment platforms that allow multiple accounts. Services like PayPal and Stripe offer business accounts with advanced features and greater flexibility in managing multiple profiles. These platforms may be a better fit for users who require extensive financial management capabilities.

Cash App for Business: A Detailed Overview

Cash App for Business is a feature designed to cater to the needs of small business owners and freelancers. It allows users to create a business profile within their existing Cash App account, providing a separate space for managing business transactions. This feature is a more compliant and efficient alternative to creating multiple personal accounts. With Cash App for Business, users can accept payments from customers, track sales, and manage their business finances all in one place. The business profile includes features such as customizable payment links, itemized transaction records, and reporting tools. These tools help business owners stay organized and gain insights into their financial performance.

One of the key benefits of Cash App for Business is its simplicity and ease of use. The platform is designed to be user-friendly, making it accessible to business owners with varying levels of technical expertise. Setting up a business profile is a straightforward process, and managing transactions is intuitive. This simplicity allows business owners to focus on their core activities without getting bogged down in complex financial management tasks. Additionally, Cash App for Business offers competitive transaction fees, making it an affordable option for small businesses. The platform also integrates with other business tools, such as accounting software, streamlining financial management processes.

Key Features of Cash App for Business

Cash App for Business offers a range of features designed to meet the needs of small business owners and freelancers. Here’s a detailed breakdown of some of the key features:

- Customizable Payment Links: Business owners can create unique payment links to share with customers. These links can be customized with the business name and logo, providing a professional and branded payment experience.

- Itemized Transaction Records: Cash App for Business provides detailed transaction records that include the date, time, amount, and description of each transaction. This feature makes it easy to track sales and manage business finances.

- Reporting Tools: The platform offers reporting tools that provide insights into business performance. Business owners can generate reports on sales, expenses, and other key metrics, helping them make informed decisions.

- Employee Access: Cash App for Business allows business owners to grant access to employees, enabling them to manage transactions and perform other tasks. This feature is useful for businesses with multiple employees.

- Instant Deposits: Business owners can opt for instant deposits, allowing them to access their funds quickly. This feature is particularly useful for businesses that need immediate access to their cash flow.

- Cash Card for Business: Cash App offers a Cash Card specifically designed for business owners. This card can be used to make purchases, withdraw cash from ATMs, and manage business expenses.

- Integration with Other Tools: Cash App for Business integrates with other business tools, such as accounting software, streamlining financial management processes.

Advantages of Using Cash App for Business

Using Cash App for Business offers several advantages over creating multiple personal accounts or using a personal account for business transactions. One of the primary benefits is compliance with Cash App’s terms of service. By using the business feature, users can manage their business finances without violating the platform’s rules. This reduces the risk of account suspension or other penalties. Another advantage is the enhanced financial management capabilities. Cash App for Business provides tools and features specifically designed for business owners, making it easier to track sales, manage expenses, and gain insights into their financial performance. Users consistently report that separating business and personal finances significantly improves their ability to manage cash flow and prepare for taxes.

Furthermore, Cash App for Business offers a professional and branded payment experience. Customizable payment links and the option to add a business logo help create a consistent brand image. This can enhance customer trust and improve the overall customer experience. The platform also offers competitive transaction fees, making it an affordable option for small businesses. Our analysis reveals these key benefits: improved compliance, enhanced financial management, professional branding, and cost-effectiveness. For many small business owners, Cash App for Business provides a simple and efficient solution for managing their finances.

Review of Cash App for Business: Is It Right for You?

Cash App for Business offers a streamlined solution for managing business finances, but is it the right choice for every business owner? Let’s delve into a balanced review, considering user experience, performance, and potential limitations.

User Experience & Usability: From a practical standpoint, Cash App for Business is incredibly easy to set up and use. The interface is intuitive, and the process of creating a business profile is straightforward. Even users with limited technical skills can quickly navigate the platform and manage their transactions. The mobile app is well-designed and responsive, providing a seamless experience on both iOS and Android devices.

Performance & Effectiveness: In our experience with Cash App for Business, the platform delivers on its promises. Payments are processed quickly and reliably, and the reporting tools provide valuable insights into business performance. The customizable payment links work seamlessly, and the option to add a business logo enhances the professional image. However, it’s important to note that Cash App for Business may not be suitable for businesses with complex financial needs or high transaction volumes.

Pros:

- Ease of Use: The platform is incredibly user-friendly, making it accessible to business owners with varying levels of technical expertise.

- Compliance: Using Cash App for Business ensures compliance with the platform’s terms of service, reducing the risk of account suspension.

- Professional Branding: Customizable payment links and the option to add a business logo enhance the professional image.

- Competitive Fees: Cash App for Business offers competitive transaction fees, making it an affordable option for small businesses.

- Integration: The platform integrates with other business tools, streamlining financial management processes.

Cons/Limitations:

- Limited Features: Cash App for Business offers fewer features than dedicated accounting software or payment platforms.

- Transaction Limits: The platform may have transaction limits that could be restrictive for businesses with high transaction volumes.

- Customer Support: Customer support can be slow to respond at times, which can be frustrating for users who need immediate assistance.

- Security Concerns: As with any financial platform, there are security risks to be aware of. Users should take precautions to protect their accounts from unauthorized access.

Ideal User Profile: Cash App for Business is best suited for small business owners, freelancers, and entrepreneurs who need a simple and affordable solution for managing their business finances. It’s particularly well-suited for businesses that primarily accept payments through mobile devices or online channels.

Key Alternatives: Two main alternatives to Cash App for Business are PayPal and Stripe. PayPal offers a wider range of features and integrations, making it a better fit for businesses with complex financial needs. Stripe is a more developer-friendly platform that offers advanced customization options.

Expert Overall Verdict & Recommendation: Overall, Cash App for Business is a solid choice for small business owners and freelancers who need a simple and affordable solution for managing their finances. While it may not offer all the features of dedicated accounting software or payment platforms, its ease of use and compliance with Cash App’s terms of service make it a valuable tool. We recommend Cash App for Business to businesses that prioritize simplicity and affordability over advanced features. However, businesses with complex financial needs or high transaction volumes may want to consider alternative platforms like PayPal or Stripe.

Navigating the Complexities of Digital Finance

In conclusion, while Cash App discourages creating multiple personal accounts, legitimate needs often arise. Using Cash App for Business is a compliant and efficient way to manage business finances within the platform. It offers enhanced financial management capabilities, a professional branding experience, and competitive transaction fees. Understanding the nuances of Cash App’s policies and exploring alternative strategies ensures you can manage your finances effectively without violating the terms of service. Leading experts in digital finance suggest prioritizing compliance and utilizing the available business features to maintain a secure and efficient financial ecosystem.

As the digital finance landscape evolves, staying informed and adapting to new tools and strategies is crucial. Whether you’re a freelancer, small business owner, or simply looking to manage your finances more effectively, understanding your options and making informed decisions is key. Share your experiences with managing multiple income streams or business finances using Cash App in the comments below. Explore our advanced guide to budgeting for freelancers for more in-depth strategies.