Unlocking the Power of Apple Card with Cash App: A Comprehensive Guide

The intersection of finance and technology continues to evolve, offering users increasingly seamless ways to manage their money. Two prominent players in this landscape are Apple Card and Cash App. Many users wonder about the possibilities of linking these platforms. This guide provides a comprehensive exploration of the relationship between Apple Card and Cash App, detailing what’s possible, what’s not, and alternative strategies to maximize the benefits of both.

We’ll delve into the intricacies of using your Apple Card with Cash App, clarifying common misconceptions, and offering practical tips for efficient money management. Whether you’re a seasoned user of both platforms or just getting started, this guide will equip you with the knowledge to make informed decisions and optimize your financial experience. Our aim is to provide clarity and actionable insights, drawing upon expert analysis and user experience to ensure you have a solid understanding of how these two financial tools can (or can’t) work together.

Understanding the Apple Card Ecosystem

Apple Card, launched in partnership with Goldman Sachs, is designed to integrate seamlessly with the Apple ecosystem. It exists both as a physical titanium card and a digital card within the Apple Wallet app on iPhones and iPads. Key features that define Apple Card include its daily cash rewards, spending tracking tools, and no annual fees.

The core principles behind Apple Card are simplicity, transparency, and privacy. The card offers a clear and easy-to-understand rewards program, provides detailed spending summaries within the Wallet app, and prioritizes user data security. Apple Card is designed to be a modern credit card that adapts to the digital lifestyle of its users.

Apple Card’s Key Features

- Daily Cash: Earn a percentage of every purchase back as Daily Cash, which is credited to your Apple Cash card.

- No Fees: No annual fees, late fees, or foreign transaction fees.

- Spending Tracking: Detailed spending summaries and visualizations within the Wallet app.

- Titanium Card: An optional physical card with a minimalist design and no visible card number, CVV, expiration date, or signature.

- Security: Advanced security features, including Face ID and Touch ID authentication.

Cash App: A Mobile Payment Powerhouse

Cash App, developed by Block, Inc. (formerly Square, Inc.), is a mobile payment service that allows users to send and receive money quickly and easily. It functions as a digital wallet, enabling users to store funds, make online and in-person purchases, and even invest in stocks and Bitcoin. Cash App has become a popular alternative to traditional banking services, particularly among younger demographics.

The app’s user-friendly interface and versatile features have contributed to its widespread adoption. Cash App simplifies financial transactions, offering a convenient way to split bills, pay friends, and manage personal finances. Its accessibility and range of functionalities make it a valuable tool in the modern financial landscape.

Cash App’s Core Functionalities

- Peer-to-Peer Payments: Send and receive money instantly with other Cash App users.

- Cash Card: A customizable debit card linked to your Cash App balance.

- Direct Deposit: Receive paychecks and other deposits directly into your Cash App account.

- Investing: Buy and sell stocks and Bitcoin directly within the app.

- Boosts: Instant discounts and rewards at participating merchants.

Can You Directly Link Apple Card to Cash App? The Short Answer

Unfortunately, you cannot directly link your Apple Card to Cash App. Cash App primarily supports linking to debit cards and bank accounts. While you can add a credit card to Cash App for sending payments, Apple Card is not directly supported for this purpose. Attempting to add the Apple Card often results in an error message or rejection.

This limitation stems from the way Apple Card is structured and how Cash App processes transactions. Apple Card is designed to work primarily within the Apple ecosystem and with merchants that accept Apple Pay or traditional credit card payments. Cash App’s infrastructure is built around debit cards and bank accounts for funding transactions.

Workarounds and Alternative Strategies for Using Apple Card with Cash App

While a direct link isn’t possible, there are several workarounds to leverage the benefits of both Apple Card and Cash App:

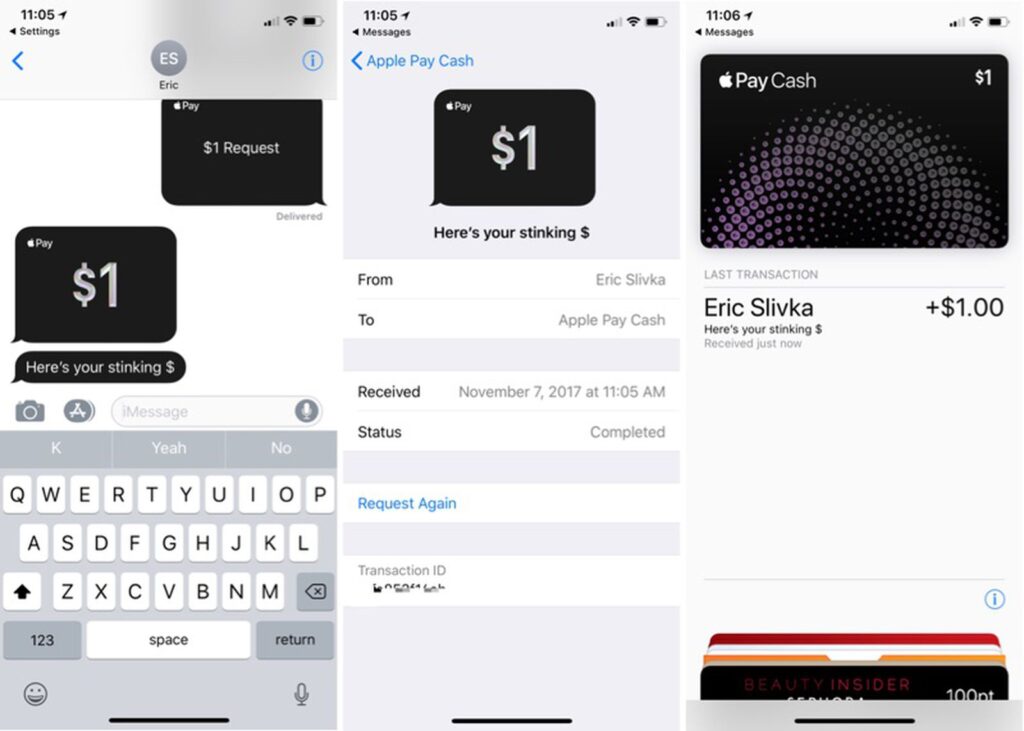

1. Using Apple Cash as an Intermediary

The most straightforward method involves using Apple Cash as a bridge between your Apple Card and Cash App. Here’s how it works:

- Earn Daily Cash: Use your Apple Card for purchases to earn Daily Cash rewards.

- Transfer to Apple Cash: Your Daily Cash is automatically deposited into your Apple Cash card within the Apple Wallet.

- Transfer to Bank Account: From Apple Cash, transfer the funds to your linked bank account.

- Add Bank Account to Cash App: Link the same bank account to your Cash App account.

- Use Cash App: Now you can use the funds transferred from Apple Cash via your bank account in Cash App.

This method involves a few extra steps, but it allows you to indirectly utilize the rewards earned from your Apple Card within Cash App. It’s a reliable way to move funds between the two platforms, albeit not instantaneous.

2. Using Apple Pay and Cash App Together (Where Applicable)

Some merchants allow you to pay with Apple Pay within their apps or websites. If a merchant accepts Apple Pay and you have your Apple Card set up as the default payment method in Apple Pay, you can indirectly use your Apple Card with Cash App by making purchases through these merchants.

For instance, if you’re using a delivery service that integrates with Cash App and also accepts Apple Pay, you could use your Apple Card through Apple Pay to fund the transaction initiated within Cash App. This scenario is dependent on the specific merchant’s payment options.

3. Cashing Out Apple Cash to a Debit Card (with Limitations)

While Apple Cash primarily supports transfers to bank accounts, you can also attempt to cash out to a linked debit card. However, this method may incur fees and is subject to certain limitations. If you have a debit card linked to both Apple Cash and Cash App, you could try transferring funds from Apple Cash to the debit card and then using that debit card within Cash App.

Keep in mind that this approach might not be the most cost-effective due to potential fees associated with debit card transfers. Also, ensure that your debit card is compatible with both platforms to avoid any transaction errors.

Apple Card Family Sharing and Cash App

Apple Card offers a Family Sharing feature, allowing you to share your Apple Card with family members who are part of your Apple Family group. This feature extends the benefits of Apple Card to multiple users, making it easier to manage household expenses and track spending. However, even with Family Sharing, the limitations regarding direct linking to Cash App remain.

Family members using a shared Apple Card can still utilize the Apple Cash intermediary method described above to indirectly use their rewards within Cash App. Each family member can transfer their Daily Cash earnings to their respective Apple Cash cards and then transfer those funds to a linked bank account that is also connected to their Cash App account.

Advantages of Using Apple Card and Cash App Separately

While direct integration is limited, there are distinct advantages to using Apple Card and Cash App as separate tools, each tailored to specific financial needs:

Apple Card: Building Credit and Earning Rewards

Apple Card is excellent for building credit due to its reporting to credit bureaus. Responsible use of the card, including timely payments, can positively impact your credit score. The Daily Cash rewards program also provides a tangible benefit, allowing you to earn a percentage back on every purchase. The card’s integration with the Apple Wallet app offers detailed spending insights, helping you track your expenses and manage your budget effectively.

Cash App: Convenient Peer-to-Peer Payments and Investing

Cash App excels in facilitating quick and easy peer-to-peer payments. It’s ideal for splitting bills with friends, sending money to family members, or paying for services. The app’s investing features also provide a convenient way to buy and sell stocks and Bitcoin, making it a versatile tool for managing your finances. The Cash Card, a customizable debit card linked to your Cash App balance, allows you to make purchases online and in-person, further enhancing the app’s utility.

Potential Future Integrations

The financial technology landscape is constantly evolving, and it’s possible that future integrations between Apple Card and Cash App could emerge. As both platforms continue to grow and adapt to user needs, there may be opportunities for partnerships or feature enhancements that allow for more seamless interaction.

For example, Apple and Block, Inc. could explore collaborations that enable direct linking of Apple Card to Cash App, or they could introduce new features that streamline the process of transferring funds between the two platforms. Such integrations would undoubtedly enhance the user experience and provide greater flexibility in managing finances.

Optimizing Your Financial Workflow with Apple Card and Cash App

Even without direct integration, you can optimize your financial workflow by strategically using Apple Card and Cash App for their respective strengths. Here are some tips:

- Use Apple Card for Daily Purchases: Maximize your Daily Cash rewards by using Apple Card for everyday purchases, such as groceries, gas, and dining.

- Use Cash App for Peer-to-Peer Transactions: Leverage Cash App for splitting bills, sending money to friends and family, and paying for services.

- Automate Transfers: Set up recurring transfers from your Apple Cash to your linked bank account to ensure funds are readily available for use within Cash App.

- Track Spending: Utilize the spending tracking features in both Apple Wallet and Cash App to monitor your expenses and manage your budget effectively.

- Take Advantage of Boosts: Explore Cash App’s Boosts program to earn instant discounts and rewards at participating merchants, further enhancing the value of your transactions.

A Look at Alternatives to Cash App

While Cash App is a popular choice for mobile payments, several alternatives offer similar functionalities and may provide better integration with certain credit cards or banking services. Here are a couple of notable alternatives:

Venmo

Venmo, owned by PayPal, is another widely used mobile payment app that allows users to send and receive money quickly and easily. Venmo offers a similar set of features to Cash App, including peer-to-peer payments, a debit card, and the ability to buy and sell cryptocurrencies. While Venmo may not directly support Apple Card linking either, it’s still a well-regarded alternative to consider. Venmo is particularly known for its social feed, which allows users to share transactions with friends (with privacy settings, of course).

PayPal

PayPal is a long-standing online payment platform that enables users to send and receive money, make online purchases, and manage their finances. PayPal offers a broader range of services than Cash App, including international payments and business accounts. While PayPal may not offer the same level of peer-to-peer payment focus as Cash App, it provides a more comprehensive suite of financial tools. PayPal often has better integration with a wider range of credit cards, but you still will not be able to directly link your Apple Card to PayPal in most cases.

Making Informed Decisions About Your Finances

While directly linking your Apple Card to Cash App isn’t possible, understanding the nuances of each platform allows you to create a strategic financial workflow. By leveraging the strengths of both Apple Card and Cash App, you can optimize your spending, earn rewards, and manage your finances effectively. As the financial technology landscape continues to evolve, staying informed about potential integrations and alternative solutions will empower you to make informed decisions and maximize the benefits of these powerful tools. Remember that responsible credit card use is essential for building and maintaining a healthy credit score, and careful budgeting is crucial for achieving your financial goals. Explore the options, understand the limitations, and take control of your financial future.